More About Nj Cash Buyers

Table of ContentsA Biased View of Nj Cash BuyersThe Basic Principles Of Nj Cash Buyers How Nj Cash Buyers can Save You Time, Stress, and Money.Examine This Report about Nj Cash Buyers

Many states grant consumers a particular degree of security from financial institutions regarding their home. Some states, such as Florida, completely exempt the house from the reach of specific creditors. Various other states set restrictions ranging from just $5,000 to up to $550,000. "That means, no matter the value of your home, creditors can not require its sale to satisfy their claims," says Semrad.You can still go into foreclosure via a tax obligation lien. If you fall short to pay your residential property, state, or federal taxes, you might lose your home with a tax lien. Getting a residence is a lot easier with money. You don't have to wait for an assessment, evaluation, or underwriting.

(https://www.whatsyourhours.com/usa/real-estate-property/nj-cash-buyers)I know that many sellers are extra most likely to accept a deal of money, yet the vendor will certainly obtain the cash no matter of whether it is funded or all-cash.

Nj Cash Buyers - An Overview

Today, concerning 30% people homebuyers pay money for their homes. That's still in the minority. There might be some great reasons not to pay cash. If you just have sufficient cash money to pay for a home, you may not have actually any kind of left over for repair services or emergency situations. If you have the cash, it could be a great concept to establish it apart to ensure that you have at the very least three months of real estate and living expenditures should something unforeseen happen was losing a task or having clinical problems.

You may have certifications for an exceptional home mortgage. According to a current research study by Cash magazine, Generation X and millennials are considered to be populaces with one of the most possible for development as consumers. Taking on a little of financial debt, particularly for tax purposes excellent terms could be a much better option for your finances overall.

Maybe purchasing the securities market, common funds or a personal organization may be a far better choice for you in the long run. By buying a property with cash, you run the risk of depleting your reserve funds, leaving you vulnerable to unforeseen upkeep expenditures. Having a property entails ongoing expenses, and without a home mortgage pillow, unanticipated fixings or improvements might strain your financial resources and impede your capability to maintain the residential property's condition.

The Nj Cash Buyers Ideas

Home rates fluctuate with the economic situation so unless you're intending on hanging onto the house for 10 to 30 years, you may be far better off spending that money elsewhere. Buying a building with cash can speed up the purchasing process substantially. Without the requirement for a home loan authorization and associated documents, the deal can close much faster, giving an one-upmanship in competitive actual estate markets where vendors may favor cash money buyers.

This can lead to substantial price financial savings over the long-term, as you will not be paying passion on the funding amount. Money buyers commonly have more powerful arrangement power when handling sellers. A cash money deal is more eye-catching to sellers since it minimizes the threat of a bargain failing due to mortgage-related concerns.

Keep in mind, there is no one-size-fits-all option; it's crucial to customize your choice based upon your specific scenarios and long-term ambitions. Prepared to begin looking at homes? Give me a call anytime.

Whether you're selling off assets for a financial investment residential property or are faithfully saving to acquire your desire abode, buying a home in all cash money can substantially boost your buying power. It's a strategic action that reinforces your setting as a buyer and improves your flexibility in the realty market. It can place you in a monetarily at risk spot.

The Single Strategy To Use For Nj Cash Buyers

Saving on interest is among the most typical reasons to get a home in money. Throughout a 30-year mortgage, you might pay 10s of thousands and even numerous countless dollars in overall passion. Additionally, your investing in power increases without financing backups, you can explore a more comprehensive selection of homes.

Property is one financial investment that has a tendency to outpace inflation gradually. Unlike stocks and bonds, it's taken into consideration much less dangerous and can give brief- and long-lasting riches gain. One caution to note is that throughout particular financial markets, property can create much less ROI than other investment enters the brief term.

The greatest threat of paying cash for a house is that it can make your funds unpredictable. Binding your fluid possessions in a building can minimize economic versatility and make it extra challenging to cover unforeseen expenditures. In addition, linking up your cash money means missing out on high-earning investment possibilities that might produce greater returns in other places.

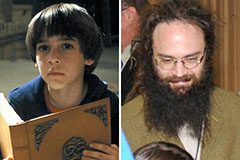

Barret Oliver Then & Now!

Barret Oliver Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Morgan Fairchild Then & Now!

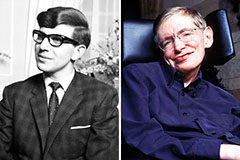

Morgan Fairchild Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!